Alpha Hunter Portfolio

Build Your RealTest Portfolio

Instantly test how multiple RealTest strategies perform together without merging code.

Fast & Easy

How It Works

1. Move Strategy Sliders

Set how much capital goes into each strategy. Adjust the sliders to test different allocation mixes.

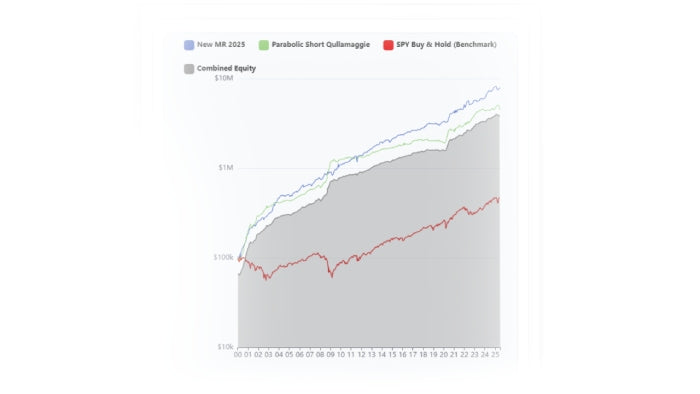

2. View the Equity Curve

See how the combined portfolio would have performed. The chart updates instantly based on your weights.

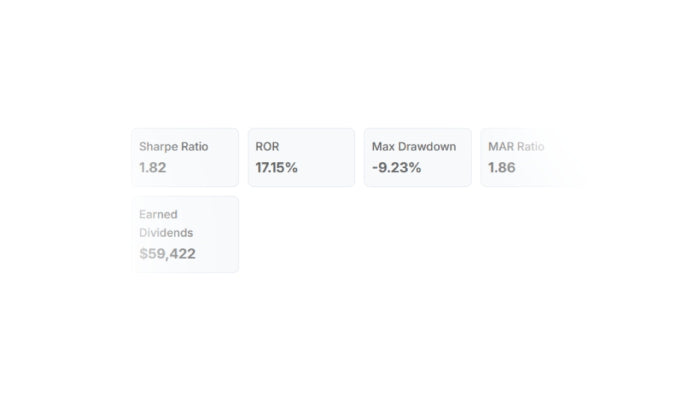

3. Analyze Portfolio Stats

Sharpe, drawdown, MAR Ratio all calculated from the selected strategies and weights.

4. Download What You Need

When you find a portfolio mix that aligns with your risk tolerance, download or purchase the individual strategies instantly.

Dream Portfolio

Build Your Portfolio In Seconds

Customize Strategy Allocation

| Strategy | Weight ($) | |

|---|---|---|

| Starting Balance | $0 |

- Free Ongoing Support

- 30-Day Refund

- Trusted by traders using IBKR + RealTest

- No Curve Fitting, Robust

Frequently Asked Questions

Can I run this strategy in RealTest without coding?

Yes. All strategies are ready to load and run. No coding required. Just open RealTest, select the file, and hit “Run.”

What data do I need?

You need Norgate Premium Data (U.S. stocks) to avoid survivorship bias and ensure proper backtests.

Can I use this in Python, AmiBroker, or other platforms?

Yes. Each strategy includes a full text description of the logic, so you can rebuild it in other platforms.

We’ve had users convert to Python, AmiBroker, TradeStation, and more.

What if I don’t understand something?

Just ask. Every purchase includes free support, we’re happy to walk you through setup, testing, or logic questions.

Do you offer a refund?

Yes.We provide a 30-day money-back guarantee for your peace of mind. If the strategy logic or performance metrics differ from what is shown on our website, or if there are coding errors or issues, we will offer a full refund.

Can I get help customizing or combining strategies?

Yes. We offer services to custom code, fix, or combine strategies into one RealTest portfolio or even prep them for live trading. Check our Service pages.