Home / RealTest Strategies / RealTest Mean Reversion Trading Strategy for 2025

RealTest Mean Reversion Trading Strategy for 2025

30-Day Refund

Free Ongoing Support

Full RealTest code

A reliable, high-efficiency mean reversion system that keeps working, even as markets change.

Included files

- RealTest file (.rts)

- Rules in .TXT file with RealTest code for the AmiBroker or Python users

Requirements

- RealTest

- Norgate Data – US Stocks (Platinum / Diamond package)

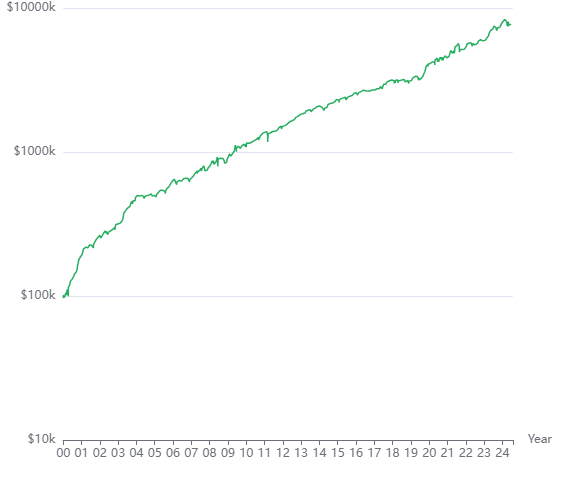

Strategy Equity Curve

Combined Monthly Percent Gains

Survivourship Bias Free

This strategy uses Norgate’s Premium data, ensuring every backtest includes both delisted (past) and current stocks.

Backtested with Real Cost

- This strategy incorporates brokers (IBKR) commission.

- Slippage applied to market orders.

- Added limit extra buffers reflecting real-world trading fills.

Robust Logic, No Curve-Fitting

Built on fundamental market drivers not overfitted indicator formulas. Our strategies prioritize robustness and simplicity over complexity for its own sake.

30-Day Refund

If the strategy logic or performance metrics differ from what is shown on our website, or if there are coding errors or issues, we will offer a full refund. Read more.

Free Ongoing Support

We’re here to help with everything from setup to step-by-step strategy customization.

No Coding Needed

How To Use

Download strategy, open RealTest, click "import" and "test".

Frequently Asked Questions

What do I get when I buy a strategy?

Each strategy includes the RealTest (.rts) file and a fully written-out text file detailing the strategy rules. This makes it easy to adapt the logic for Python, Amibroker, TradeStation, or other platforms.

The product description clearly outlines the included files, so you know exactly what you're getting.

Can I trust the backtests?

Yes, and here’s why:

- We use robust testing techniques (out-of-sample, Monte Carlo, walk-forward)

- We include trading costs, avoid survivorship bias, and don’t over-optimize

If a strategy doesn’t pass our own robustness checks, it’s not sold.

How do I combine multiple strategies?

If you're building a portfolio:

- We help you combine uncorrelated strategies in RealTest (trend, breakout, mean reversion, short)

- You can build “all-weather” setups and even apply dynamic weighting (based on VIX, trend filters, etc.)

- Ask for help, we’ll guide you

We recommend starting with four systems - Portfolio Builder.

What happens after I buy?

Here’s the usual process:

- Download files

- Open RealTest

- Open downloade file in RealTest

- Click test

We're available throughout this process if you need help.

Can I run this strategy in RealTest without coding?

Yes. All strategies are ready to load and run. No coding required. Just open RealTest, select the file, and hit “Run.”

What data do I need?

Most strategies are designed for Norgate Premium Data (U.S. stocks) to avoid survivorship bias and ensure proper backtests. Norgate Silver data works fine if you want only live trade. Some simpler strategies can also use Yahoo Finance. Check each product page for specifics.

Can I use this in Python, AmiBroker, or other platforms?

Yes. Each strategy includes a full text description of the logic, so you can rebuild it in other platforms.

We’ve had users convert to Python, AmiBroker, TradeStation, and more.

How is the forecasted performance calculated?

Below the monthly performance chart, you can see the average gain/loss for each month. If the next month is August, the forecast uses August’s historical average performance, then converts that percentage into a dollar value. All forecasts are statistical estimates, not guarantees.

What if I don’t understand something?

You can message us. Every purchase includes free support.

Whether it’s a setup issue, RealTest usage, or logic clarification, we’ll walk you through it. You’re not left alone.

Do you offer a refund?

Yes.We provide a 30-day money-back guarantee for your peace of mind. If the strategy logic or performance metrics differ from what is shown on our website, or if there are coding errors or issues, we will offer a full refund.

Can I get help customizing or combining strategies?

Yes. We offer services to custom code, fix, or combine strategies into one RealTest portfolio or even prep them for live trading. Check our Service pages.